Someone says you harmed them. That statement is the raw core of every liability claim. It means they believe you are legally responsible for causing them injury or loss, and they want you to make it right, usually with money. This isn’t about criminal guilt or jail time; it’s a civil matter about responsibility and compensation. When this happens, you are facing a potential liability claim.

At its simplest, a liability claim arises from the basic idea that we all have a duty not to cause unreasonable harm to others. If you breach that duty through action or inaction, and it directly causes damage to someone else, you may be held “liable.“ The harm isn’t always physical. It can be damage to property, like crashing into someone’s fence. It can be financial, like a bad business deal caused by your error. It can be reputational, like spreading a false story. Or it can be physical and emotional, like a serious injury from a car accident you caused.

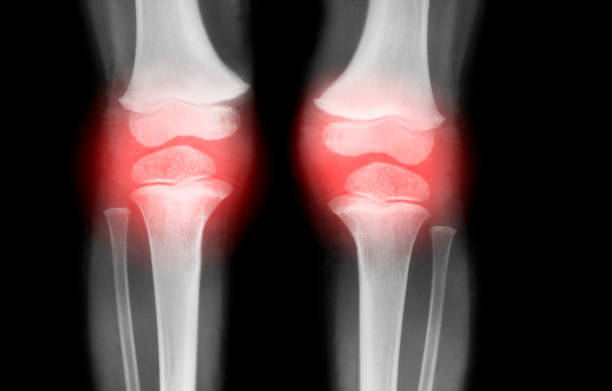

The person making the claim, the claimant, has the burden to prove three key things. First, that you owed them a duty of care—a basic standard of reasonable behavior. A driver owes a duty to other drivers to operate their car safely. A store owner owes a duty to customers to clean up spills. Second, they must show you breached that duty. You were texting and driving, or you left the spill for hours without a warning sign. Third, they must prove that your breach directly caused their verifiable damages. Your distracted driving caused the crash that broke their arm, leading to medical bills and lost wages. The spilled lemonade caused their fall and back injury.

Your response to a claim is critical. Do not ignore it. Acknowledgement is not an admission of guilt. Listen carefully to understand exactly what they are alleging. Be cautious about what you say or write, as statements can be used later. Immediately notify any relevant insurance company you have—whether auto, home, or business. This is precisely what your liability insurance is for. Their job is to investigate, defend you, and handle settlement discussions if warranted. If you have no insurance, you may need to consult a lawyer to understand your personal exposure.

Throughout the process, gather and preserve any evidence. This includes photos of the scene, records of communications, witness contact information, and your own clear written account of what happened. This evidence is crucial for your insurer or lawyer to build a defense or to accurately evaluate the strength of the claimant’s case.

Most liability claims are resolved through negotiation and settlement long before a courtroom is involved. An insurance adjuster and the claimant’s representative will debate fault and the value of the damages. A settlement is often a practical business decision to avoid the greater cost and uncertainty of a trial. If a settlement cannot be reached, the claim may turn into a lawsuit. But remember, a demand letter or even a filed lawsuit is still part of the same continuum—it’s a formal step in the process of someone saying you harmed them and seeking to hold you liable. Your focus should remain on a clear-eyed assessment of the facts, your legal duties, and the actual damages caused.